Big Lots no credit check policy has sparked considerable discussion. This approach, eschewing traditional credit options, forces a closer look at Big Lots’ payment methods, customer experiences, and overall sales strategies. The absence of credit cards as a payment option raises questions about accessibility for various customer segments and the retailer’s marketing approach.

This analysis delves into the specifics of Big Lots’ payment options, comparing them to competitors. We’ll examine customer feedback, exploring both positive and negative experiences stemming from the lack of credit facilities. Furthermore, we’ll investigate the impact of this policy on Big Lots’ sales and marketing, and explore alternative financing solutions available to customers.

Big Lots’ Payment Options and Their Impact: Big Lots No Credit Check

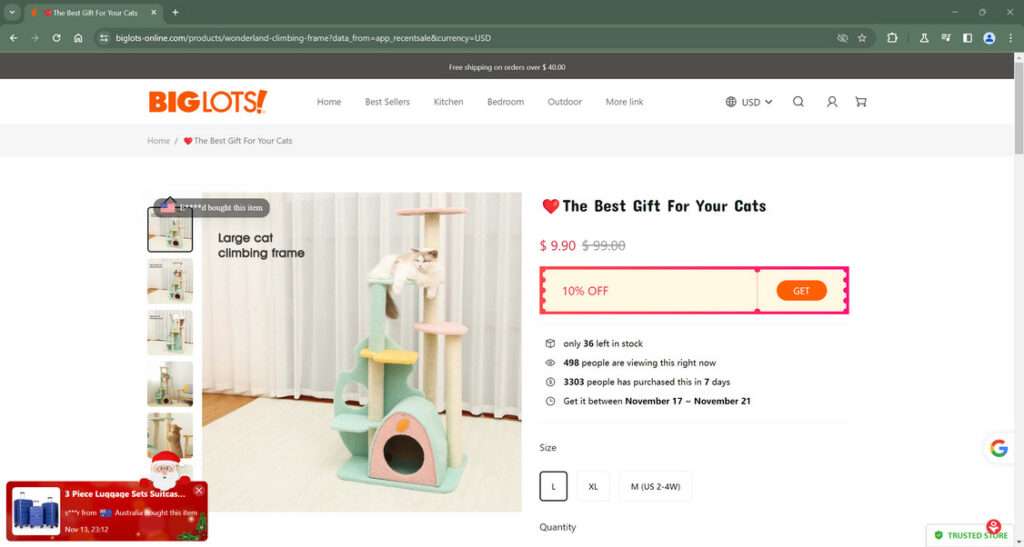

Source: malwaretips.com

Big Lots distinguishes itself from many competitors by its “no credit check” policy. This approach, while simplifying the checkout process for some, also limits payment options and potentially impacts its customer base and marketing strategies. This article examines Big Lots’ payment methods, customer experiences, the implications of its credit policy, and potential alternatives for shoppers.

Big Lots’ Accepted Payment Methods

Big Lots accepts a range of payment methods both in-store and online. These include major credit cards (Visa, Mastercard, American Express, Discover), debit cards, cash, and Big Lots gift cards. Store credit, issued for returns or exchanges, can also be used. Unlike many retailers, Big Lots does not offer store-branded credit cards or any form of financing.

Comparison with Competitors, Big lots no credit check

Compared to competitors like Walmart, Target, or Kohl’s, Big Lots’ payment options are more limited. These competitors often offer store credit cards and other financing options, providing customers with more flexibility, especially for larger purchases. This lack of financing at Big Lots could potentially exclude customers with limited immediate funds but a willingness to pay over time.

| Retailer | Credit Cards | Debit Cards | Cash | Other Payment Methods |

|---|---|---|---|---|

| Big Lots | Yes (Visa, Mastercard, Amex, Discover) | Yes | Yes | Gift Cards, Store Credit |

| Walmart | Yes | Yes | Yes | Walmart Pay, Gift Cards, Store Credit, Financing Options |

| Target | Yes | Yes | Yes | Target Circle Rewards, Gift Cards, Store Credit, Financing Options |

| Kohl’s | Yes | Yes | Yes | Kohl’s Cash, Gift Cards, Store Credit, Financing Options |

Customer Experiences with Big Lots’ Payment System

Customer experiences with Big Lots’ payment system are varied. Many appreciate the straightforwardness of the available options and the ease of using debit cards or cash. Positive feedback often centers on the speed and efficiency of the checkout process. However, the absence of credit options has led to negative experiences, particularly for customers who prefer or require installment payments for larger purchases.

- Positive Experiences (Debit/Cash): “Checkout was quick and easy. I paid with my debit card and was in and out in minutes.”

- Negative Experiences (Lack of Credit): “I wanted to buy a new washer and dryer but couldn’t because I couldn’t afford the full price upfront and they don’t offer financing.”

- Gift Card Experiences: “Using my gift card was seamless. The cashier processed it without any issues.”

Common complaints revolve around the lack of credit options and the inability to spread payments over time. Customers seeking larger purchases often find themselves restricted by their immediate financial capacity.

- Lack of financing options

- Inability to use alternative payment methods like Buy Now, Pay Later services

- Limited flexibility for larger purchases

Impact of “No Credit Check” Policy on Sales and Marketing

Big Lots’ “no credit check” policy likely attracts customers who prefer cash transactions or those with concerns about credit utilization. However, it might alienate potential customers who rely on credit for larger purchases. Marketing strategies could focus on highlighting value, affordability, and the convenience of quick, straightforward transactions. Big Lots’ marketing materials generally emphasize low prices and everyday savings, indirectly reflecting the simplicity of its payment options.

The absence of credit options is not a prominent feature of their marketing campaigns.

Alternatives to Credit for Big Lots Customers

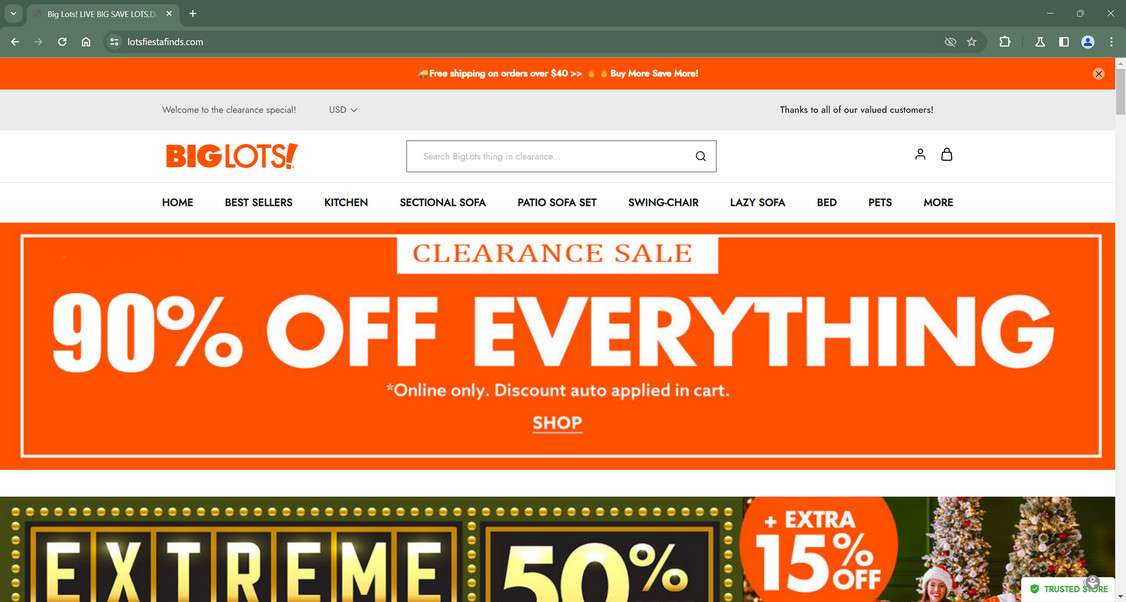

Source: malwaretips.com

Customers can explore alternative financing options like personal loans, layaway plans (if offered), or using savings. Budgeting apps and financial planning tools can help customers manage their spending and save for larger purchases. Buy Now, Pay Later (BNPL) services, while not directly offered by Big Lots, are available through other platforms and could potentially provide a solution for some customers, though fees and interest rates should be carefully considered.

| Alternative | Fees | Interest Rate | Eligibility |

|---|---|---|---|

| Personal Loan | Origination fees may apply | Varies depending on lender and credit score | Good to excellent credit typically required |

| Buy Now, Pay Later | Late fees, potential interest charges | Varies depending on provider | Generally less stringent credit requirements than traditional loans |

| Savings Plan | None | None | Requires discipline and advance planning |

Visual Representation of Big Lots’ Payment Information

Big Lots’ website and in-store signage generally use clear and concise language to display accepted payment methods. The visuals are typically straightforward, using standard icons for credit cards and other payment types. Fonts are generally easy to read, and the color scheme is consistent with the overall store branding.

To improve clarity and accessibility, Big Lots could consider incorporating visual cues to emphasize the lack of financing options while promoting the speed and ease of other methods. For example, they could use a graphic depicting a quick checkout process or highlight the convenience of cash and debit card payments.

Other retailers, such as Target, often use vibrant colors and clear iconography to highlight their various payment methods, including those related to their credit cards and rewards programs. This approach makes the payment information easily scannable and understandable for shoppers.

Summary

Big Lots’ decision to forgo traditional credit options presents a unique case study in retail strategy. While it may exclude some potential customers, it also forces a focus on alternative payment methods and potentially strengthens the retailer’s position with cash-focused shoppers. The success of this strategy hinges on effectively communicating available options and offering competitive pricing and promotions to attract a broad customer base.

Further research into consumer spending habits and preferences in relation to this policy would be beneficial.