St Louis County Property Tax: Navigating the complexities of property taxes in St. Louis County can be daunting, impacting homeowners’ budgets and financial planning significantly. This comprehensive guide unravels the intricacies of assessment, rates, exemptions, payment processes, and the overall influence of these taxes on the community, providing clarity and essential resources for residents.

From understanding the varying tax rates across different municipalities and property types to mastering the appeals process and exploring available exemptions, this resource equips homeowners with the knowledge to effectively manage their property tax obligations. We’ll delve into the calculation methods, explore payment options, and highlight resources available for those facing financial hardship. The impact of property taxes on home values and the broader economic landscape of St.

Louis County will also be examined.

Understanding St. Louis County Property Tax Rates: St Louis County Property Tax

Property taxes in St. Louis County, Missouri, are a significant source of revenue for local governments, funding essential services like schools, public safety, and infrastructure. Understanding how these taxes are calculated and applied is crucial for homeowners and property owners. This section details the various rates, calculation processes, and components of a typical tax bill.

Property Tax Rate Variations

Source: propertytaxgov.com

St. Louis County’s property tax rates are not uniform; they vary significantly depending on the specific municipality and the type of property. Higher-valued properties in affluent areas typically face higher rates, while those in less developed areas may have lower rates. Commercial properties often have different tax rates than residential properties, reflecting their different contributions to the local economy.

These variations are largely determined by the individual taxing entities within each municipality, including school districts, county government, and other special districts.

Calculating Property Taxes

The property tax calculation involves two main steps: assessment and rate application. The County Assessor’s office determines the assessed value of a property, which is typically a percentage of its market value. This assessment is then multiplied by the applicable tax rates for the property’s location and type. The resulting figure represents the annual property tax liability.

Components of a Property Tax Bill

A typical St. Louis County property tax bill is composed of several distinct charges. These include the county tax, municipal tax, school district tax, and potentially other special district levies. Each entity sets its own tax rate, contributing to the overall tax amount. Additionally, interest and penalties may be added for late payments.

Average Property Tax Rates by Municipality

The following table presents average property tax rates for selected municipalities within St. Louis County. It’s important to note that these are averages and individual rates may vary based on property type and location within the municipality.

| Municipality | Average Residential Rate | Average Commercial Rate | Notes |

|---|---|---|---|

| Clayton | $2.50 per $100 of assessed value (example) | $3.00 per $100 of assessed value (example) | Rates are estimates and can change yearly. |

| Webster Groves | $2.20 per $100 of assessed value (example) | $2.70 per $100 of assessed value (example) | Rates are estimates and can change yearly. |

| Kirkwood | $2.00 per $100 of assessed value (example) | $2.50 per $100 of assessed value (example) | Rates are estimates and can change yearly. |

| Ballwin | $1.80 per $100 of assessed value (example) | $2.30 per $100 of assessed value (example) | Rates are estimates and can change yearly. |

Property Assessment and Appeals

Understanding the property assessment process and the appeals procedure is crucial for ensuring fair taxation. This section details the methods used for valuation, the steps involved in filing an appeal, and examples of successful appeals.

Property Assessment Methods, St Louis County Property Tax

St. Louis County uses a variety of methods to assess property values, including comparable sales analysis, cost approaches, and income approaches. The Assessor’s office considers factors such as property size, location, condition, and features to determine the market value. These assessments are periodically reviewed and updated.

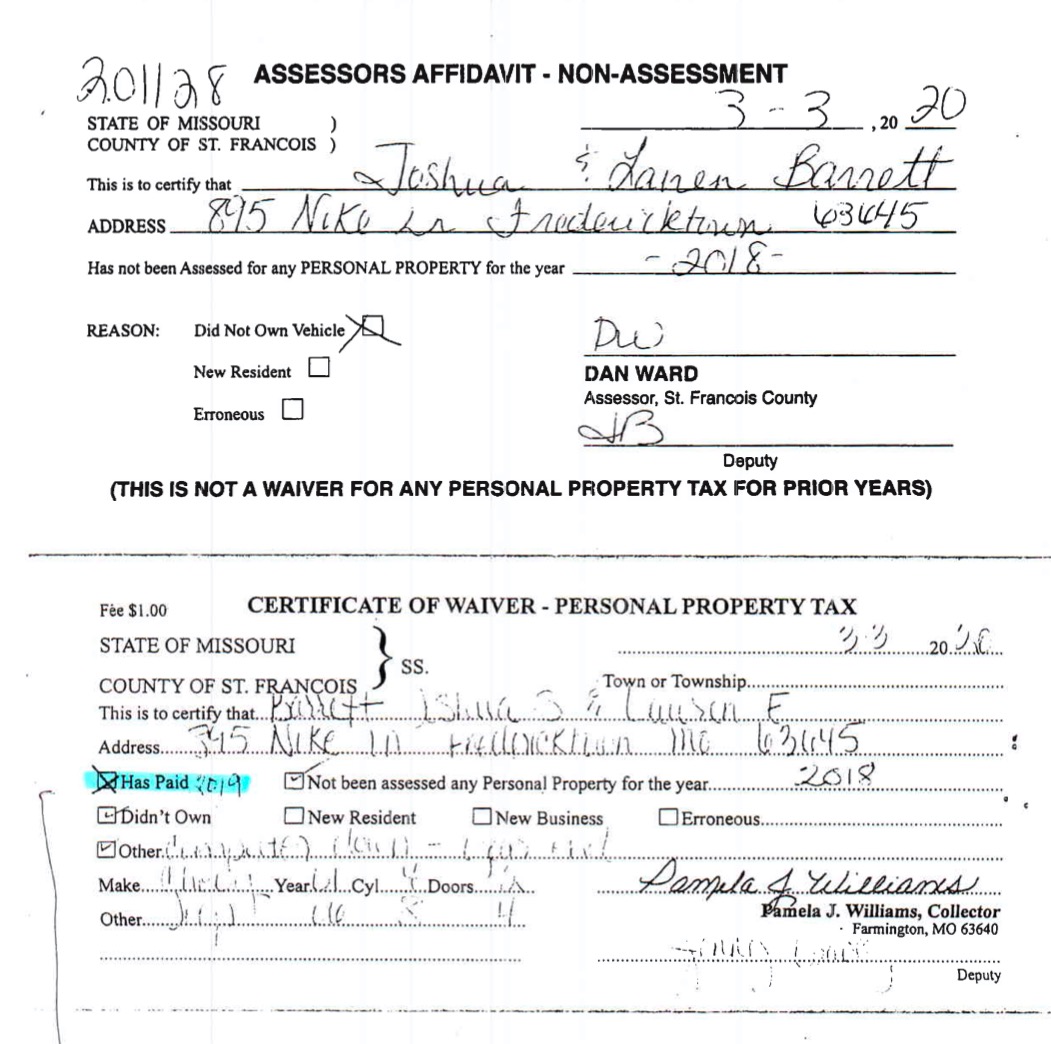

Appealing a Property Tax Assessment

Homeowners who believe their property assessment is inaccurate can file an appeal with the St. Louis County Board of Equalization. The appeal process involves submitting necessary documentation, such as comparable property sales data and evidence of any unique circumstances affecting the property’s value. Timely submission is crucial, as there are strict deadlines for filing appeals.

Examples of Successful Appeals

Several successful appeals have involved demonstrating significant discrepancies between the assessed value and recent comparable sales in the neighborhood. Cases where the assessor overlooked key property features or failed to account for significant repairs or renovations have also resulted in successful appeals. Detailed documentation and a strong case are key to a successful appeal.

Step-by-Step Guide for Filing an Appeal

- Gather supporting documentation, including comparable sales data and photos.

- Complete the appeal form provided by the Board of Equalization.

- Submit the completed form and supporting documentation before the deadline.

- Attend the hearing (if required) and present your case.

- Review the Board’s decision and consider further appeal options if necessary.

Tax Exemptions and Abatements

Several tax exemptions and abatements are available to reduce the property tax burden for eligible residents. Understanding these programs can significantly impact a homeowner’s financial obligations. This section provides details on eligibility criteria and application procedures.

Types of Property Tax Exemptions

St. Louis County offers various property tax exemptions, including those for senior citizens, veterans, and individuals with disabilities. Specific eligibility criteria apply to each exemption, and documentation is usually required to support the application. These exemptions can significantly reduce or eliminate property tax liabilities for qualifying individuals.

Eligibility Criteria and Application Process

Each exemption has its own set of eligibility requirements, such as age, income level, disability status, or military service record. The application process generally involves submitting the necessary documentation to the County Assessor’s office. The office will review the application and determine eligibility.

Impact of Tax Abatements

Tax abatements, often used as incentives for economic development, can reduce property taxes for a specific period. While they can stimulate growth, they also impact the overall tax revenue available for public services. The long-term effects of tax abatements are often carefully considered by local governments.

Comparison of Tax Exemptions

| Exemption Type | Eligibility Criteria | Benefit | Application Process |

|---|---|---|---|

| Senior Citizen | Age and income restrictions (example) | Partial or full exemption (example) | Application to Assessor’s office (example) |

| Veteran | Military service record (example) | Partial or full exemption (example) | Application to Assessor’s office (example) |

| Disability | Proof of disability (example) | Partial or full exemption (example) | Application to Assessor’s office (example) |

Payment Methods and Deadlines

Prompt payment of property taxes is essential to avoid penalties and interest charges. This section details the accepted payment methods, deadlines, and consequences of late payment. Information on payment plans for those facing financial hardship is also included.

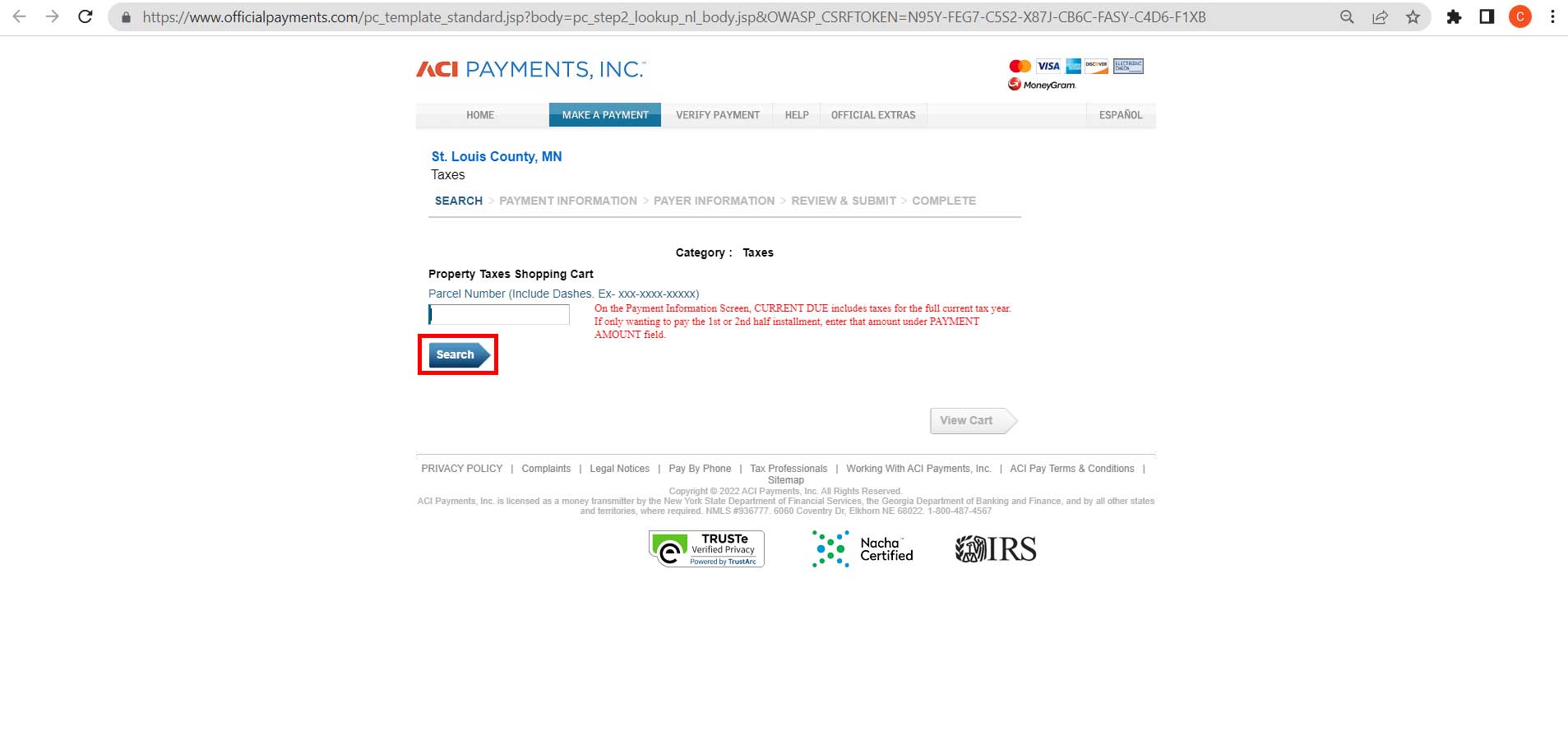

Accepted Payment Methods

St. Louis County typically offers several convenient ways to pay property taxes, including online payments, mail-in payments, and in-person payments at designated locations. Specific instructions and details are usually available on the County Treasurer’s website.

Consequences of Late Payments

Late payments usually result in penalties and interest charges, adding to the original tax amount. The specific penalties and interest rates are Artikeld in the tax bill and on the County Treasurer’s website. Prompt payment is crucial to avoid these additional costs.

Payment Plans and Hardship Programs

For taxpayers facing financial difficulties, payment plans or hardship programs may be available. These programs offer flexibility in paying property taxes over an extended period, reducing the immediate financial burden. Contacting the County Treasurer’s office is essential to explore these options.

Property Tax Payment Process Flowchart

A flowchart would visually depict the steps involved in paying property taxes, starting with receiving the tax bill, selecting a payment method, submitting payment, and receiving confirmation. It would highlight key deadlines and potential outcomes, such as penalties for late payment or successful payment confirmation.

Resources and Further Information

Several resources are available to assist property owners with questions or concerns regarding their property taxes. This section lists key websites, contact information, and frequently asked questions.

Key Websites and Contact Information

The St. Louis County Assessor’s office and Treasurer’s office websites provide comprehensive information on property taxes, including assessment details, tax rates, payment methods, and deadlines. Contact information for both offices is readily available on their respective websites.

St. Louis County property tax assessments are a significant concern for many residents, impacting budgeting and financial planning. Understanding the complexities of these assessments requires careful review, and for those needing a quick overview, a helpful resource might be a concise summary, perhaps even a 10 min tim er style guide, to quickly grasp the key points.

Ultimately, timely understanding of St. Louis County property tax regulations is crucial for responsible financial management.

Organizations Offering Assistance

Several organizations provide assistance to taxpayers with property tax issues, offering guidance on appeals, exemptions, and payment options. These organizations often provide free or low-cost services to help individuals navigate the complex property tax system.

Frequently Asked Questions

What is the deadline for paying property taxes?

How can I appeal my property tax assessment?

What types of property tax exemptions are available?

What happens if I pay my property taxes late?

Resources for Understanding Tax Implications Before Purchasing Property

Before purchasing property, it’s crucial to research property tax rates and assessments for the specific area. Reviewing past tax bills and consulting with real estate professionals can provide valuable insights into potential tax liabilities. This due diligence helps in making informed financial decisions.

Impact of Property Taxes on Homeowners

Property taxes significantly impact homeowners’ budgets and financial planning. This section explores the relationship between property tax rates, property values, and homeowner finances, comparing St. Louis County’s tax burden with neighboring areas.

Property Tax Rates and Property Values

In St. Louis County, higher property values generally correlate with higher property taxes. This relationship influences home affordability and investment decisions. Fluctuations in property values directly impact the tax burden on homeowners.

Impact on Homeowner Budgets

Property taxes represent a recurring expense for homeowners, impacting their monthly budgets and overall financial planning. Understanding this expense is crucial for responsible financial management. Variations in tax rates across municipalities can significantly affect the affordability of homes in different areas.

Comparison with Neighboring Counties/States

Comparing property tax burdens in St. Louis County with those in neighboring counties or states provides context to the local tax environment. This comparison can highlight areas where St. Louis County’s tax rates are higher or lower than average, influencing the relative cost of homeownership.

Distribution of Property Tax Burdens

Source: themissouritimes.com

A visual representation (bar graph, for example) would illustrate how property tax burdens are distributed across different income levels in St. Louis County. This would show the proportion of income dedicated to property taxes by various income groups, revealing potential disparities in the tax system’s impact.

Ultimate Conclusion

Understanding St. Louis County property taxes is crucial for responsible homeownership. This guide has provided a framework for navigating the system, from calculating your tax liability to appealing assessments and exploring available exemptions. By utilizing the resources and information presented, homeowners can effectively manage their property taxes and contribute to the financial well-being of their community. Remember to stay informed about changes in legislation and utilize the available support services when needed.