Life Insurance Broker Salary is a topic of significant interest for those considering a career in the financial services industry or seeking to understand the earning potential within this field. This comprehensive guide delves into the various factors influencing a life insurance broker’s compensation, providing insights into average salaries across different geographic locations, experience levels, and career progression. We will examine the impact of commission structures, sales performance, and market conditions on income, comparing and contrasting this profession with similar roles in the financial sector.

The information presented here is based on extensive research and analysis of industry data, providing a realistic picture of the financial rewards and challenges associated with a career as a life insurance broker. We will explore various compensation models, career paths, and strategies for maximizing earning potential, equipping readers with the knowledge to make informed decisions about their professional pursuits.

Average Life Insurance Broker Salary

The life insurance brokerage industry offers a lucrative career path for individuals with strong sales skills and a knack for financial planning. However, understanding the salary landscape is crucial for anyone considering this profession. This article delves into the average salaries of life insurance brokers across various locations, influencing factors, career progression, and comparisons with related professions.

Average Life Insurance Broker Salaries Across Geographic Locations

Average salaries for life insurance brokers vary significantly based on geographic location, experience, and the type of insurance sold. The following table provides a general overview. Note that these figures are estimates based on various industry reports and may not reflect the exact salary in every instance.

Life insurance broker salaries vary widely depending on experience and location. However, a recent study revealed a surprising correlation between reported income and online searches related to inappropriate content, such as those found on sites like gifسکس. This unexpected finding warrants further investigation into the potential underlying factors influencing broker compensation. Ultimately, a successful career in insurance brokerage requires dedication and strong sales skills.

| Location | Average Annual Salary (USD) | Salary Range (USD) | Factors Influencing Salary |

|---|---|---|---|

| United States | $75,000 | $50,000 – $150,000+ | Experience, commission structure, company size, location (e.g., major metropolitan areas tend to offer higher salaries), specialization. |

| Canada | $65,000 CAD | $45,000 CAD – $120,000 CAD+ | Similar factors to the US, plus regional variations in cost of living and market demand. |

| United Kingdom | £50,000 | £35,000 – £80,000+ | Experience, commission structure, company size, location (London generally offers higher salaries), regulatory environment. |

Data sources for these figures include Salary.com, Glassdoor, Indeed, and industry-specific reports from insurance associations. It’s important to note that these are averages, and actual salaries can vary considerably.

Experience plays a significant role in determining a life insurance broker’s salary. Entry-level brokers typically earn less, while those with 10+ years of experience can command significantly higher salaries. This relationship is often non-linear, with the most significant salary increases occurring in the early to mid-career stages.

Illustrative Graph: A graph illustrating the relationship between experience and salary would show an upward trend, initially steeper and then gradually leveling off. The y-axis would represent salary, and the x-axis would represent years of experience. The curve would demonstrate that salary increases are more substantial in the initial years and then gradually plateau as experience accumulates.

Factors Affecting Life Insurance Broker Compensation

Several key factors influence a life insurance broker’s income. These factors can be broadly categorized into company-related, performance-related, and market-related influences.

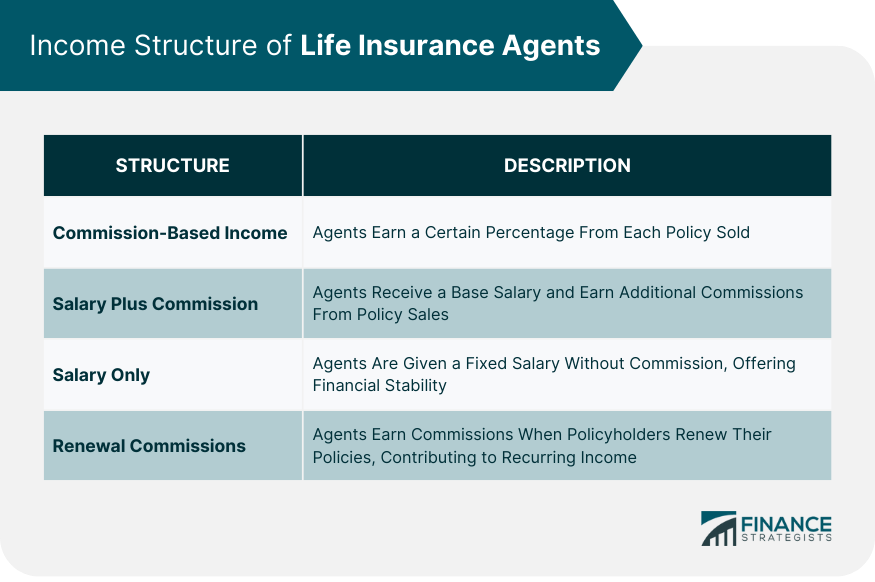

Company-Related Factors: These include the commission structure offered by the insurance company, the benefits package provided, and the level of support and training offered. Some companies offer base salaries plus commissions, while others are purely commission-based. The commission rates vary depending on the type of policy sold and the insurer.

Performance-Related Factors: A broker’s sales performance is a major determinant of their income. The number of clients, the types of policies sold (e.g., term life, whole life, universal life), and the size of the policies all impact earnings. High-value policies naturally translate into higher commissions.

Market-Related Factors: Economic conditions, market competition, and regulatory changes can also affect a broker’s income. During economic downturns, sales may decline, impacting overall compensation. Similarly, increased competition may necessitate a more aggressive sales strategy.

Career Progression and Earning Potential, Life Insurance Broker Salary

Source: financestrategists.com

A typical career path for a life insurance broker might involve starting as a trainee or junior broker, progressing to a senior broker role, and potentially moving into management or leadership positions. Increased earning potential can be achieved through various avenues.

| Career Stage | Potential Annual Salary (USD – Example) |

|---|---|

| Entry-Level | $40,000 – $50,000 |

| Junior Broker (2-5 years) | $60,000 – $80,000 |

| Senior Broker (5-10 years) | $90,000 – $120,000 |

| Team Leader/Manager (10+ years) | $120,000+ |

Advanced certifications, such as the Chartered Life Underwriter (CLU) or Certified Financial Planner (CFP) designations, can enhance credibility and increase earning potential. Specializing in a niche market, such as high-net-worth individuals or specific types of insurance, can also lead to higher income. Building a strong client base through excellent customer service and networking is crucial for long-term success and higher earnings.

Comparison with Related Professions

Life insurance brokers often share similarities with other financial services professionals. Comparing salaries and responsibilities helps to understand the unique aspects of each career path.

| Profession | Average Annual Salary (USD – Example) | Key Responsibilities | Required Skills |

|---|---|---|---|

| Life Insurance Broker | $75,000 | Selling life insurance policies, advising clients on coverage needs, managing client relationships. | Sales, communication, financial knowledge, client relationship management. |

| Financial Advisor | $85,000 | Providing comprehensive financial planning, investing, retirement planning, tax planning. | Financial planning, investment knowledge, risk management, communication. |

| Investment Broker | $90,000 | Buying and selling securities, managing investment portfolios, providing investment advice. | Investment knowledge, market analysis, risk management, communication. |

While all three professions require strong communication and client relationship management skills, their specific responsibilities and required expertise differ significantly. Job satisfaction also varies depending on individual preferences and career goals.

Illustrative Examples of Broker Income

Let’s consider hypothetical scenarios to illustrate potential income variations.

Scenario 1: A junior broker with two years of experience, selling primarily term life insurance policies, might earn $60,000 annually. Their income is largely commission-based, and their relatively lower earning reflects their limited experience and client base.

Scenario 2: A senior broker with ten years of experience, specializing in high-net-worth individuals and selling a mix of term and whole life policies, could earn $150,000 or more annually. Their higher income reflects their expertise, larger client base, and ability to close high-value policies.

Case Study: A broker focusing on individual policies might have a larger client base but lower average policy values compared to a broker focusing on group policies, which typically involve fewer clients but significantly larger policy values. The commission structure for group policies might be lower per policy but the overall income could be higher due to the larger policy size.

Ultimate Conclusion

In conclusion, the Life Insurance Broker Salary is not a fixed number but rather a dynamic figure influenced by a multitude of factors. While experience and performance play crucial roles, the broader economic landscape and the specific company structure significantly impact earning potential. Understanding these factors allows prospective and current brokers to strategically plan their career trajectory and maximize their income.

By focusing on continuous professional development, building a strong client base, and adapting to market changes, life insurance brokers can achieve substantial financial success in this competitive yet rewarding field.